-1.png)

Simon Coughlan, FOW, technology director and Matthew Cheung, CEO of ipushpull discuss the evolution of chatbots, the development of the FOW chatbot, and where the technology will go from here.

Live chat solutions have become ubiquitous across financial markets since the first business-focused applications emerged in the early 2000s. Front, middle and back-office teams quickly became comfortable with this functionality.

Over the last 20 years, chat-based technology has changed significantly, starting off with one-to-one conversations through to AI-led models such as ChatGPT3. The financial markets have seen considerable investment go into major digital transformation and automation which has helped fuel the rapid rise of chatbots.

Bots are software that can emulate human activity and processes. They can help improve efficiency through simple chat-based data queries through streamlining complex trade negotiations where machine-readable, structured objects sit within the chat alongside human-readable messages.

The ability to handle chat-based data queries may be the simplest implementation of the technology, but it is also very powerful. Operational teams can spend as much as half their time simply retrieving data and answering emails.

In recognition of this, FOW recently launched its new reference data chatbot on the Symphony market collaboration platform using ipushpull technology.

The bot enables users to retrieve the exact data they need in real time, add it to any Symphony chatroom, and respond directly to clients and colleagues without leaving their workflow.

"The increased efficiency delivered by the bot cuts down the significant time and money wasted on processing post-trade risk, clearing, settlement, and regulatory reporting issues manually, while also enabling sales and trading to access the information they need quickly."

Simon Coughlan, FOW Technology Director

Symphony was chosen as it is the communication platform with the largest network of financial institutions and professionals – more than 500,000 users across in excess of 1000 institutions.

Faster access to high-quality reference data

“We had been collaborating with ipushpull for a number of years,” explains Simon Coughlan. “One of the first conversations we had was about implementing an omnichannel approach.”

ipushpull’s low code data sharing and workflow automation platform enables a bot to be configured to connect whatever type of data is required. With the coding and building addressed, the focus of the project shifted to working out how best to connect to such a large data set.

FOW’s database provides data from 110 exchanges, delivering unrivalled coverage of the global futures and options universe.

Customer feedback from mutual clients also helped to shape the development process. “We have worked closely with FOW clients who are on Symphony to develop the functionalities that would help them improve the efficiency of their data reconciliation process,” says Coughlan.

From a technology perspective, everything is done by configuration, which means new data sets and bot commands can be rolled out in a matter of hours.

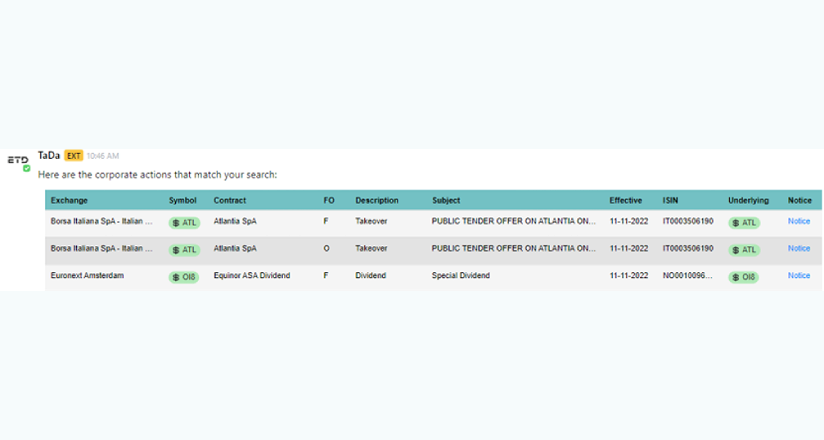

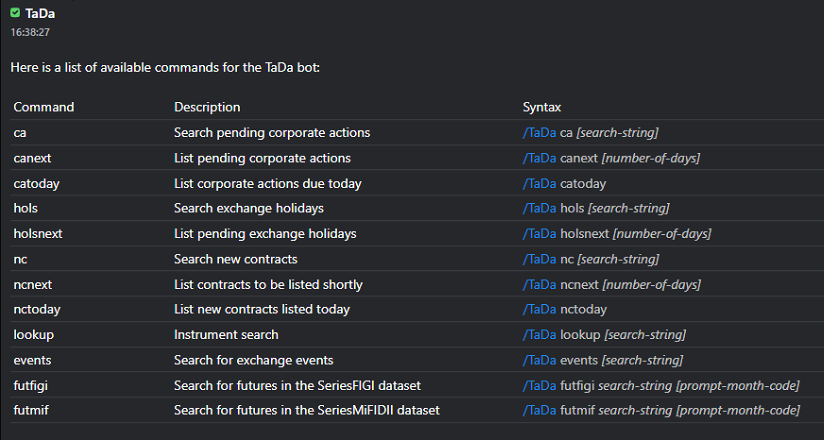

List of commands a user can use to pull FOW data through the bot

Example of Corporate Action information returned following user query

“We have gone through an iterative process of figuring out how we get different types of data sets into the platform at different frequencies using different technologies,” says Coughlan. “We push large data sets to ipushpull, which are integrated into their data tables. This enables them to put their bot on top of the platform and service it through Symphony.”

From a data storage perspective, it is important to note that ipushpull passes any data from FOW onto FOW’s pod, where it sits independently.

Utilising chatbots to integrate data delivery within workflows

One of FOW’s key tasks is getting the data onto ipushpull’s platform at the right time. For corporate actions data, for example, customers need data at a specific time for it to be useful.

The latest functionality available on the bot is the ability for an end user to create a watchlist, explains Matthew Cheung.

“In financial institutions with multiple incumbents, siloed legacy technologies that don’t talk to each other, the use cases will be more complex and require considerable data transformation to ensure the data can be used to create these customised watchlists,” he says. “This data also needs to be retrieved from the customers’ databases or platforms.”

One of the key development areas for chatbots generally is integrated workflow. If a specific notice is coming out regarding an expiry or a corporate action or an identifier has changed, the right person needs to be notified at the right time.

To make the user’s life even easier, this can be delivered with the appropriate context to enable them to trigger the necessary workflow, either on the desktop using open standards like FDC3 or remotely over the cloud, observes Cheung.

Future applications of chatbots for derivatives trading

“This is happening in post-trade with reference data and also in pre-trade with sales and trading,” he says. “We will also start to see natural language processing becoming more evident in chat-based workflows, although we are probably still a few years away from this point due to the ever-changing specific vocabulary or vernacular used in some workflows, which can be difficult to model.”

He refers to an example of an early adopter who has built bots for post-trade confirmations for equity derivatives. In this scenario, there is a tier-one bank on the other side and the bots just deal with each other without any human intervention.

"One ipushpull broker client has reported an increase of 70% in the volume of trades because the post-trade process is now so simple."

Matthew Cheung, CEO, ipushpull

There will always be some tasks that humans need to get involved in but using technology to massively reduce the time required to retrieve data will enable front-office, middle and back-office teams to self-serve and free up time that can be used to work on higher value tasks. Teams that embrace this type of technology receive instant responses rather than waiting for their colleagues to respond to emails.

Feedback from FOW customers indicates that their teams spend almost half their time manually retrieving and reconciling siloed and fragmented data to report updates to clients and colleagues.

Communication based on email, spreadsheets and legacy systems involves a considerable risk of human error, reputational damage and capital losses.

“The next phase of use cases relevant to our customer base will largely focus on customisation,” says Coughlan. “We add value by pushing data into a common model. Many of our customers want their subscribed data sets available via a bot, as well as getting the data faster and moving towards real-time data access eventually.”

According to FOW’s technology director, we have only scratched the surface of what chatbots are capable of.

“This service represents a step change in efficiency for operational teams and a huge improvement in the customer experience, whether for internal or external consumption,” he concludes.

To find out more about chatbots, you can listen to this podcast where FOW, ipushpull and Symphony dive deeper into these topics.

-1.png?width=2000&name=Untitled%20(45)-1.png)

.png?width=1200&height=628&name=Blog%20header-1%20(27).png)

.png)

.png)