TRUSTED BY GLOBAL FINANCIAL INSTITUTIONS

%20copy%20(1).png)

Maximise the value of your messaging data

Rapid delivery, immediate value

More trading opportunities

Capture, structure and respond to price requests in real time.

Improve desk efficiency

Replace manual workflows with structured, audited automation.

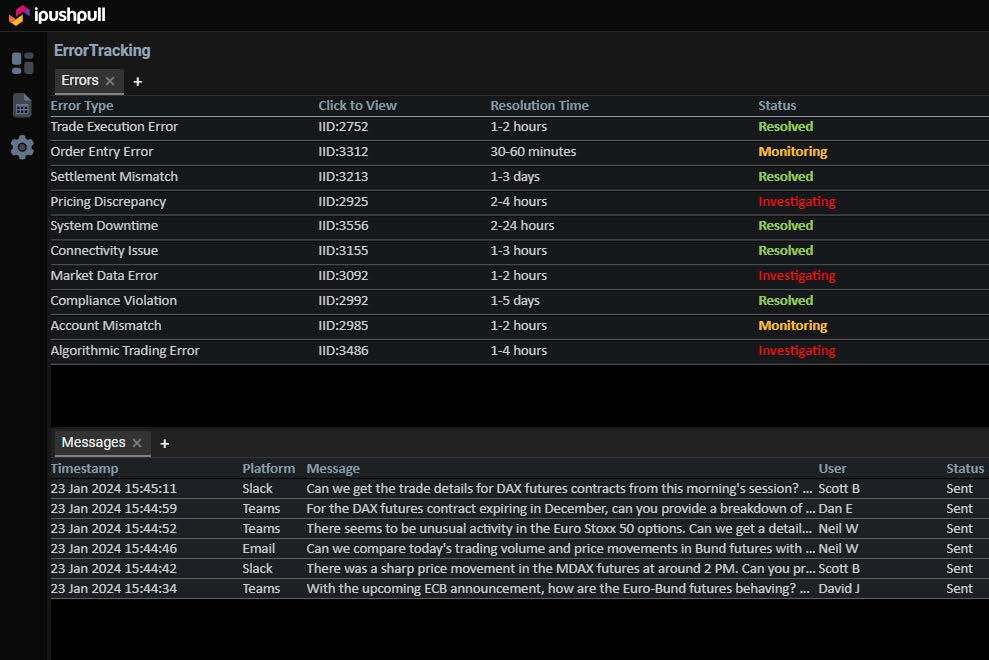

Real-time oversight

Trigger alerts, monitor messages and maintain full visibility.

Example solutions for Hedge Funds

- Trade Capture & Booking

- Chat Data Mining

- Quote Hub

- Warehouse

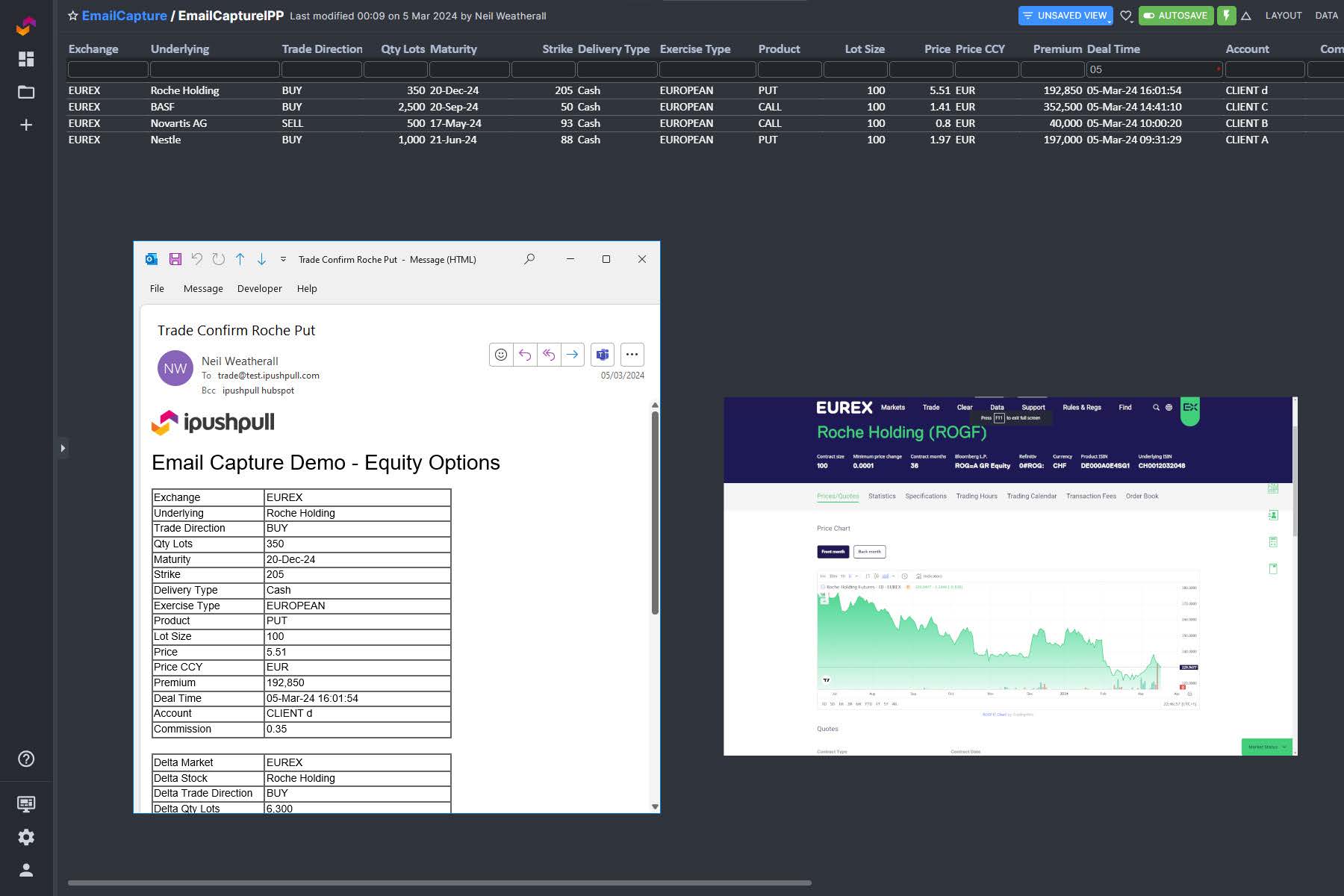

Trade Capture & Booking

Trade Capture & Booking

Automate enrichment and booking of trades to your deal management platform.

Automate reporting of trades for compliance and best execution.

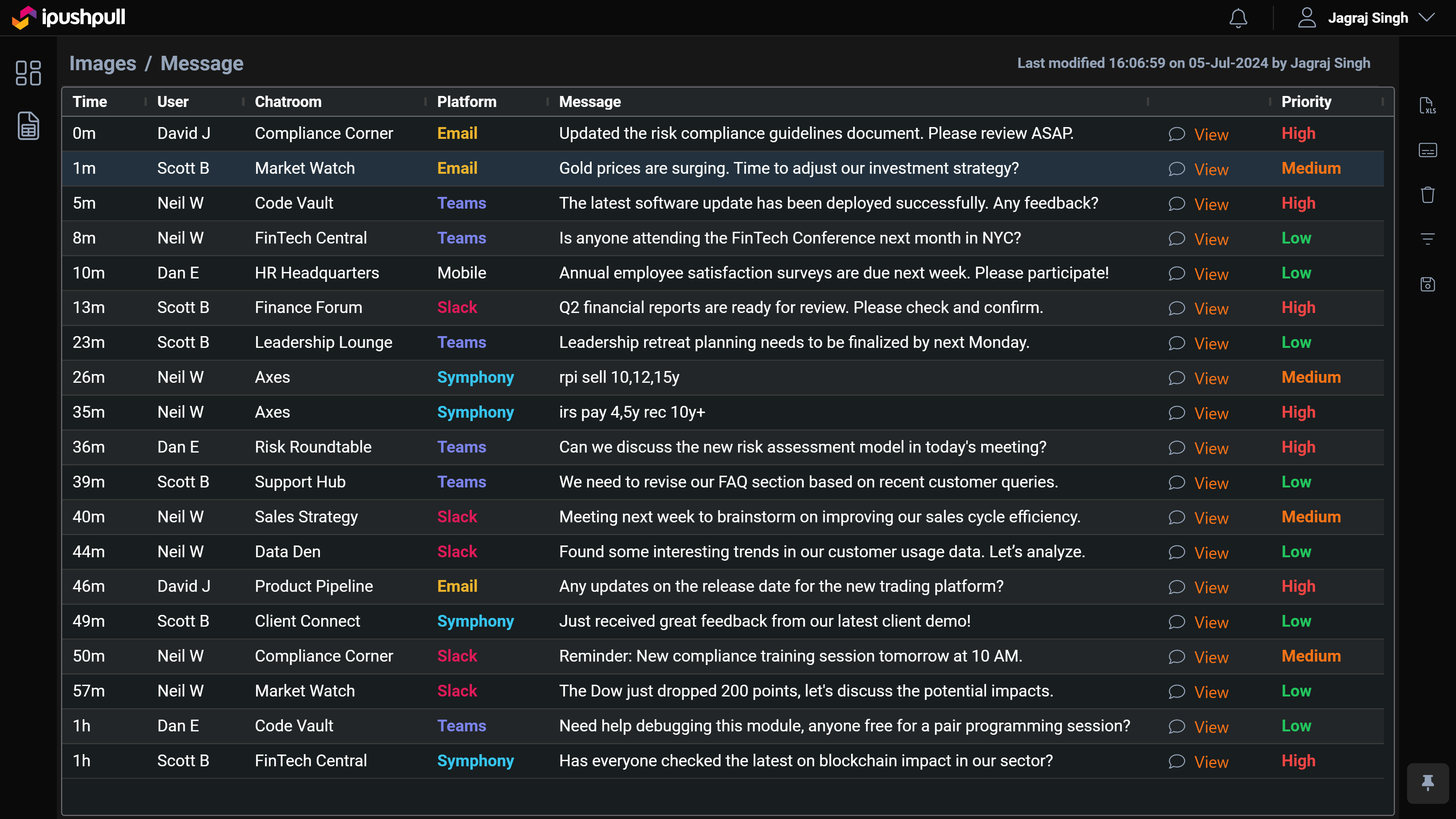

Chat Data Mining

Chat Data Mining

Once your data is structured and automation-ready, it can feed a host of other workflows and applications.

Build markets of all historic or on-the-day interest. Set up configurable or automated alerts. Create client or counterparty-facing chatbots and AI agents, with high accuracy and full control.

Quote Hub

Quote Hub

.png)

Warehouse

Warehouse

What is Your Chat Strategy?

Learn about the best practices for formulating and implementing an effective chat strategy that align with your business goals and objectives.

%20(4).jpg)

Get Inspired

Frequently asked questions

Is it easy to get started?

It is quick and easy. Simply speak to our sales team or sign up for a free trial online and we will reach out to you. ipushpull is a no-code, configurable platform which means you can connect your data easily and could be up and running for you and your clients with a proof of concept or pilot in a matter of days or even hours.

Can you help with a proof of concept?

Yes of course. Just get in touch and our support team will answer all your questions to help you get up and running fast. If you do not have the resources available, just tell us what you need, and we can create a proof of concept for you.

How is ipushpull hosted?

ipushpull is delivered as SaaS. It can be dedicated to you and include your own white-labelling URLs and customisation, or it can be delivered over a shared multi-tenant service. Our primary hosting service is AWS with the flexibility to host on a service geographically close to your business as required. We can also deliver on other hosting services if required.

Is my data secure?

Yes - ipushpull is ISO 27001 certified. Your data is secure and is encrypted in flight and when at rest. ipushpull uses encryption in transit between your applications or service and your ipushpull service and between your ipushpull service and any end-user client application. Any data stored in your ipushpull database is also encrypted.

Who are your customers?

Over 100 financial institutions that have to comply with strict regulations already use ipushpull. We’ve never had any problems with technical due diligence.

What are the top use cases?

The top use cases across Capital markets include:

-Share live price data and trade opportunities in your Excel sheet to clients or counterparties on a live web page.

-Allow clients or counterparties to access your data on demand from common chat applications with user-friendly commands.

-Send automated alerts and notifications to clients or counterparties based on your data and rules into their messaging/chat platform.

-Enabling clients or counterparties to send back orders in standard form by simply clicking on a price on a configurable web app or pop-up forms, or by typing chat commands.

-Automating tasks on the desk and monitoring your client or counterparty interest for a more efficient and improved service.

What is your charging model?

ipushpull is a SaaS platform. We offer flexible pricing based on quarterly or annual licenses with packages based on the type of hosting, and the features and solutions implemented.

-1.png?width=2000&name=Untitled%20(45)-1.png)

.png?width=1200&height=628&name=Blog%20header-1%20(27).png)

-1.png)