What is chat-to-data workflow automation for trading?

ipushpull is a chat-to-trade and chat-to-data workflow platform that sits upstream of OMS, ETRM and CTRM systems, enabling governed automation without replacing systems of record.

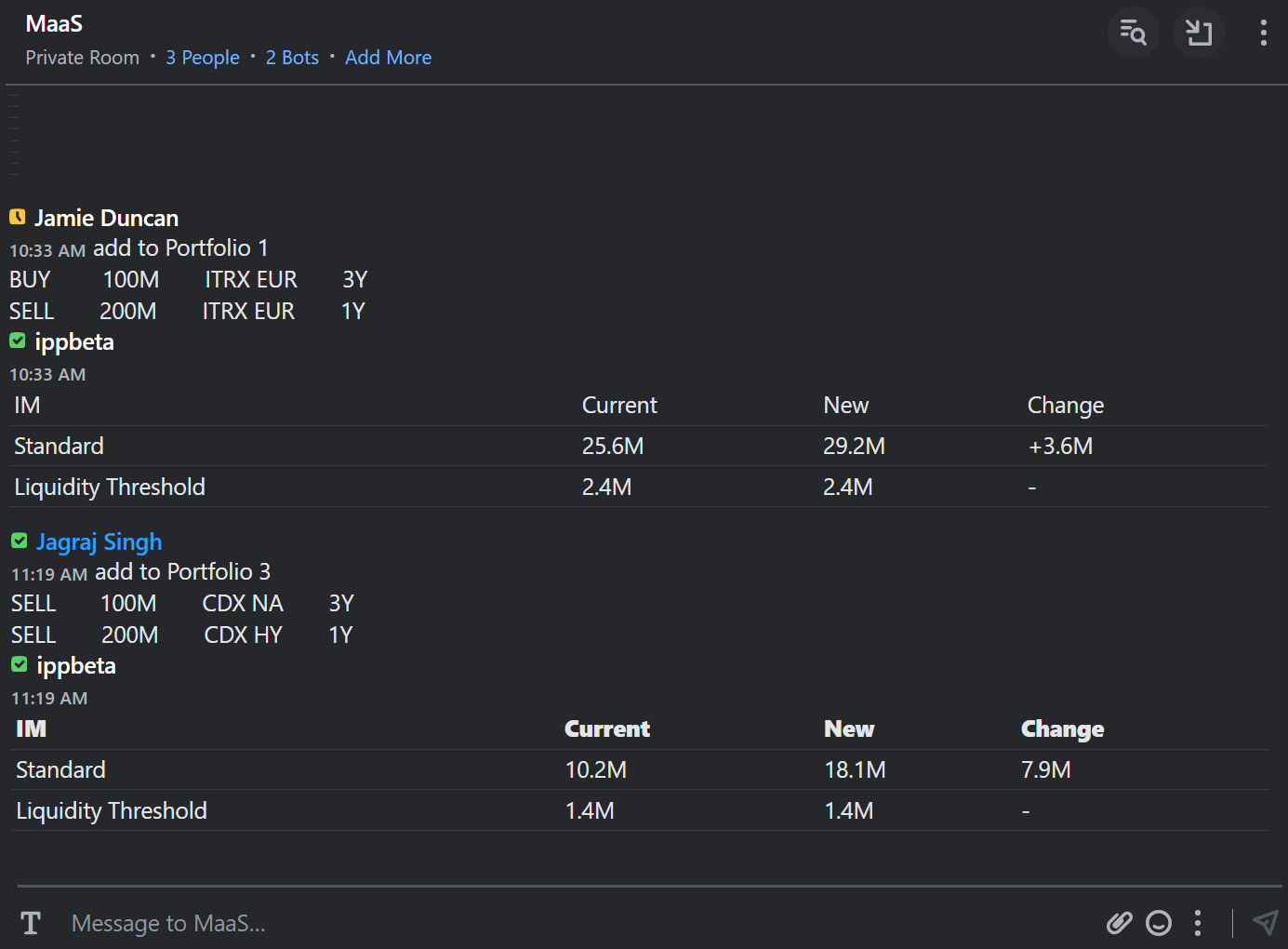

Chat-based workflow automation for trading means using enterprise chat as the trigger and control surface for pre-trade and post-trade workflows. Instead of manually keying messages into spreadsheets or systems, ipushpull captures intent in chat, validates it against permissions, routes it to the right systems, people or bots and pushes structured, permissioned trading intent into downstream systems of record and analytics platforms.

This category is powered by real-time data sharing in financial markets

Automate RFQs, quote distribution, approvals and trade capture from chat.

Standardise unstructured chat into structured workflows and data objects.

-1.png)

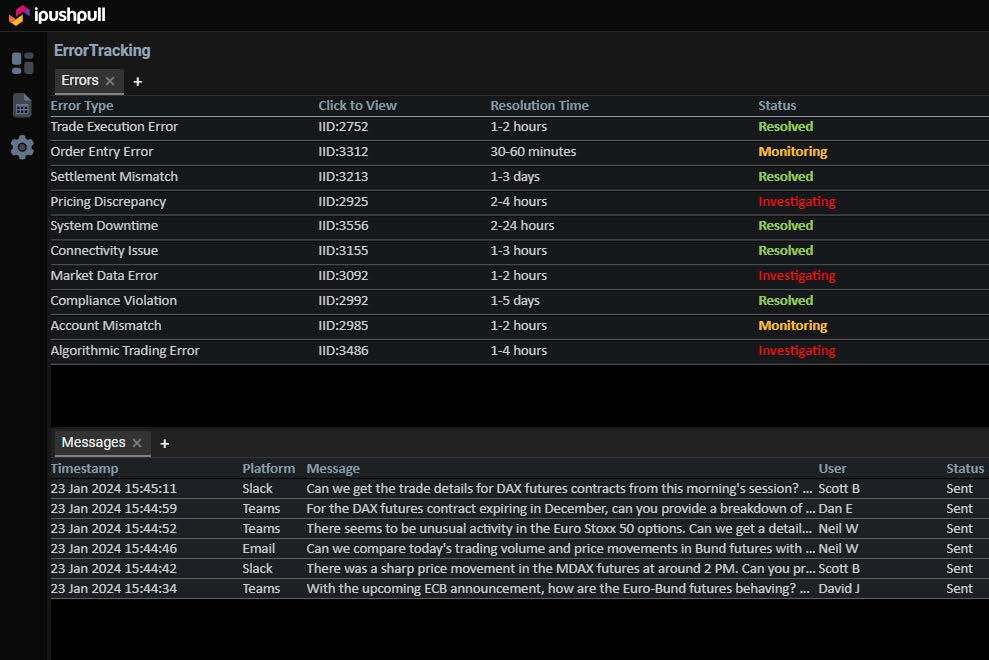

Maintain surveillance-ready audit trails in regulated environments.

What chat-based workflow automation solves

-

-Lost intent: critical details are embedded in threads.

-

-Manual rekeying: retype messages into multiple systems.

-

-Process inconsistency: workflows vary by desk and individual.

-

-Control gaps: approvals and distribution happen outside governance.

Automation fixes this by turning chat into a governed workflow surface.

How ipushpull automates workflows from chat

-

- Detect a workflow trigger in chat (command, message pattern, or bot prompt).

-

- Extract structured fields with human-in-the-loop approval (instrument, size, price, counterparty, timestamps).

-

- Validate against entitlements, thresholds and business rules.

-

- Route to traders, sales, risk, or automated agents for action/approval.

-

- Execute the next step (publish quote, update Excel, book trade, notify systems).

-

- Audit every event for surveillance and compliance.

Typical trading workflows automated in chat

-

-RFQ intake and triage

-

-Quote generation and distribution

-

-Pre-trade negotiation routing

-

-Approval chains (risk, limits, sales sign-off)

-

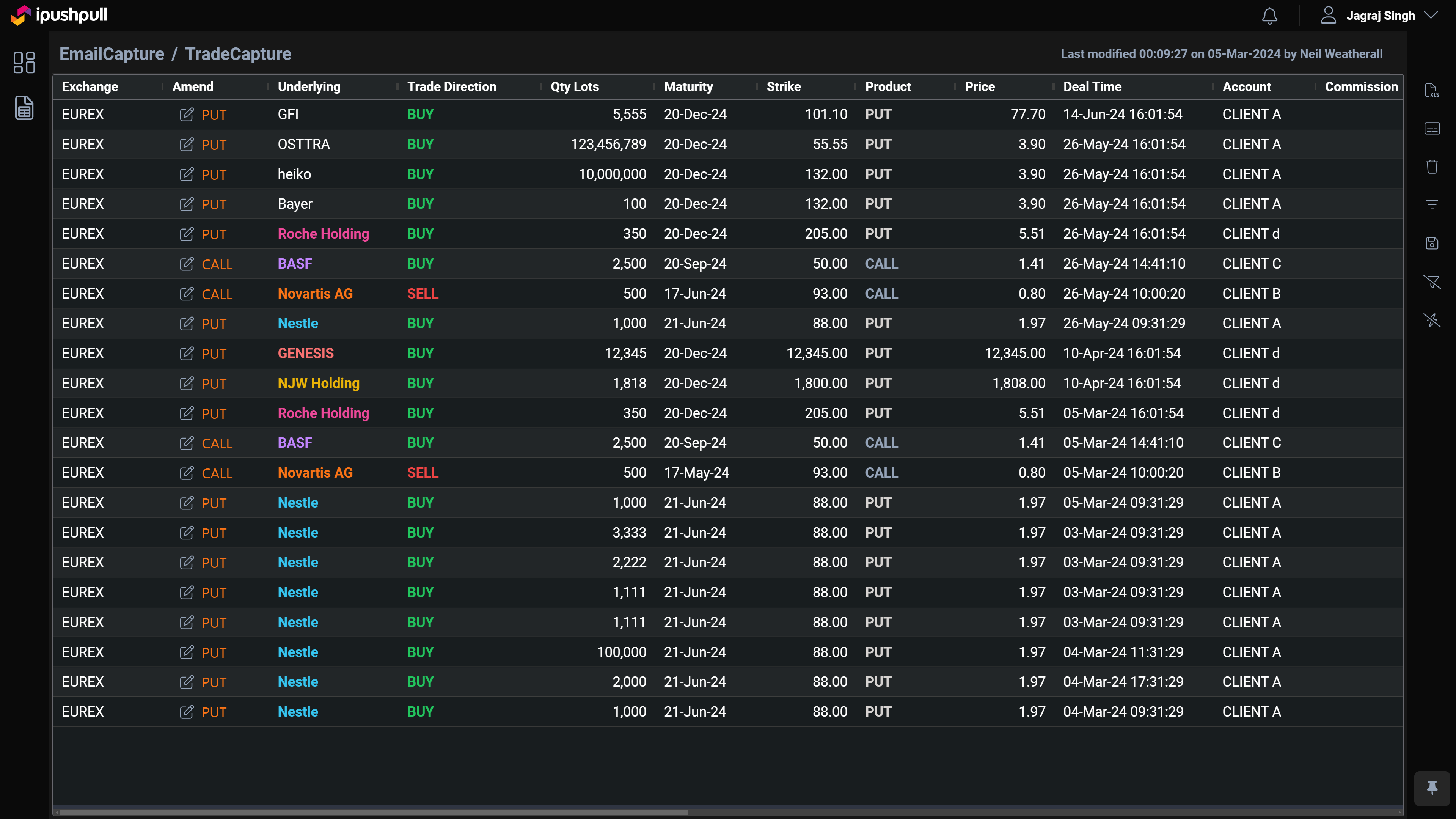

-Trade capture and booking handoff

-

-Market colour summarisation and distribution

-

-Post-trade updates to clients and internal teams

Outcomes for Trading Firms

-1.png)

Speed & Reach

Faster RFQ response and negotiation cycles.

Reduced handoff time between agreement and action.

Wider client or dealer reach

.png)

Accuracy

Fewer number of manual capture errors.

Consistent data structures across desks.

-1.png)

Control & Compliance

Permissions enforced at each step.

Central policy rules for approvals and publishing.

Full audit trail of triggers, decisions, and outputs.

Financial markets use cases

- RFQ workflow in chat

- Quote Validation and Approval

- Negotiation to booking

RFQ workflow in chat

RFQ workflow in chat

Problem: RFQs are hard to track and never recorded

ipushpull workflow: RFQ messages trigger a structured workflow, routing to the correct trader and capturing required fields.

Result: Faster, standardised RFQ handling with audit to analyse later and improve the likelihood of finding the best trade.

Quote Validation and Approval

Quote Validation and Approval

Problem: Traders and sales teams share prices and price runs in chat, but approvals are often informal, fragmented, or handled outside core systems.

ipushpull workflow: Quotes triggered in chat route to approval rules; once approved, ipushpull publishes to the right channel.

Result: Governed approval workflows to chat-distributed pricing without slowing execution.

Negotiation to booking

Negotiation to booking

Problem: Agreement in chat is manually re-entered into booking systems.

ipushpull workflow: Extract terms in chat, validate, and pass structured data to booking.

Result: Reduced errors and time-to-book.

See the full workflow in trade capture and booking automation in trading markets.

Frequently asked questions

What is chat-based workflow automation for trading?

Using enterprise chat as the trigger and control surface for trading workflows so that unstructured messages become permissioned, structured actions with audit.

Which chat platforms are supported?

Microsoft Teams, Slack, Symphony, Bloomberg and ICE Chat are available based on customer requirements and policies.

Can workflows be automated without forcing users to change how they work?

Yes. Workflows are triggered from the chat channels teams already use, so adoption relies on existing behaviour rather than new tooling.

How are approvals and permissions enforced?

Rules can be configured by product, size, price bands, roles, or desk policies. Each step is validated before publishing or booking.

How does this connect to trade capture?

Trade capture and booking is a downstream workflow within this category. Chat messages trigger extraction and validation before passing structured trades to booking systems. For more information go to the trade capture & booking page.

-1.png?width=2000&name=Untitled%20(45)-1.png)

.png?width=1200&height=628&name=Blog%20header-1%20(27).png)