Stale data is killing productivity across sales, trading and broking desks

If you represent one of the thousands of financial markets businesses using Excel today, there will be a section of your user audience who are reliant on Excel but are let down by the lack of live data. This can lead to manual workarounds, which introduce errors compound poor decision-making and, in extreme cases, lead to a loss of business. At ipushpull, we're all too aware of the negative impact this can have on clients.

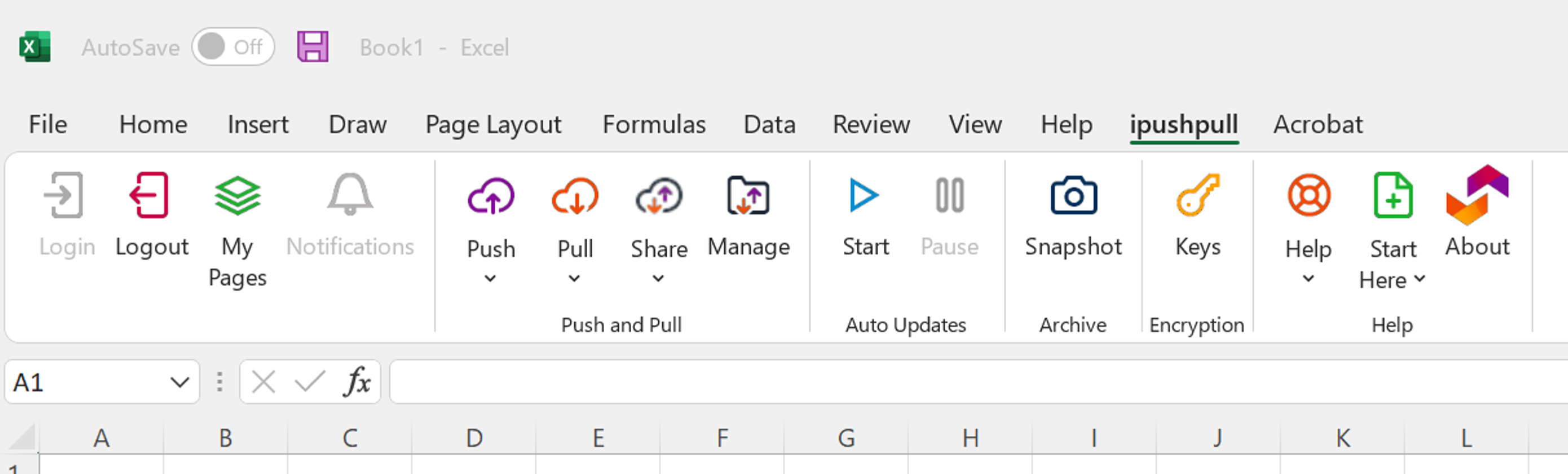

Live data sharing in Microsoft Excel is one of the most used capabilities of ipushpull. Our Microsoft Excel add-in was one of the very first out-of-the-box integrations we created, and it's now used by over 50 leading financial institutions.

There are a host of reasons why our customers have chosen to use the ipushpull live platform and Excel add-in, from distributing live data to client-side Excel to improving the performance of mission-critical live spreadsheets and reducing EUC risk. Below we will explore how ipushpull is being used by customers for the delivery of quotes, volatilities, axes, portfolios, packages and reference data live over the cloud, to teams' and clients' desktop Excel.

Common use cases across financial markets

Over the years we've seen a number of different use cases which you can be largely grouped into internal and external data sharing. In this section, we'll look at the common use cases where we've implemented solutions for clients.

Internal data sharing

- Live Quote Sharing. Sales, trading and broking desks need to share their quotes or orders live with teams or other desks that may be in different physical locations.

- Replacing Legacy Spreadsheets. Replacing legacy RTD-driven spreadsheets across the trading floor with robust and consistent price distribution into Excel and live web apps.

- Risk management. Delivering live portfolio risk by account or client into Excel for risk managers to run analysis and run their models against.

An illustration of live data being pulled into Excel using the ipushpull Excel add-in

External data sharing

- Broking/Sales Desks. Sharing live quotes or Axes with clients. For example, NatWest Markets explains how ipushpull lets them share axes with their biggest buy-side clients effectively and easily.

- Data vendors. Organisations such as FOW use ipushpull to deliver their reference data to clients, integrated directly into existing spreadsheets and workflows.

- Client Contributions. With the ipushpull add-in, clients can also push data back to a central service. BNP Paribas had just such a requirement to better serve their clients.

In a further example of the power of remote live data sharing with Excel, during the pandemic customers like Amplify Trading were able to quickly implement ipushpull to help them share live data securely between head office and traders working from home, meaning their businesses could continue uninterrupted.

An illustration of live data being pushed from Excel to other destinations

Integrate, customise and white-label

ipushpull's Excel add-ins can be quickly configured to deliver all of these use cases and be easily integrated with external platforms, such as a trading system or FIX engines.

They can be easily customised and white-labelled and are fast to deploy meaning you can quickly deliver the value of your live data, remove the friction of manual copy/paste and improve the client experience.

Or if you are trying to reduce your dependency on Excel as a desktop tool we can replace your solutions with live web apps quickly and cost-effectively. Live web apps can also be integrated into Symphony, Openfin, Finsemble and many other services.

ipushpull is already deployed in many leading financial institutions, reducing barriers to client adoption for our customers. Why not contact us to see how we can help with your live data requirements? For more information on Excel solutions go here.

-1.png?width=2000&name=Untitled%20(45)-1.png)

.png?width=1200&height=628&name=Blog%20header-1%20(27).png)

.png)

.png)