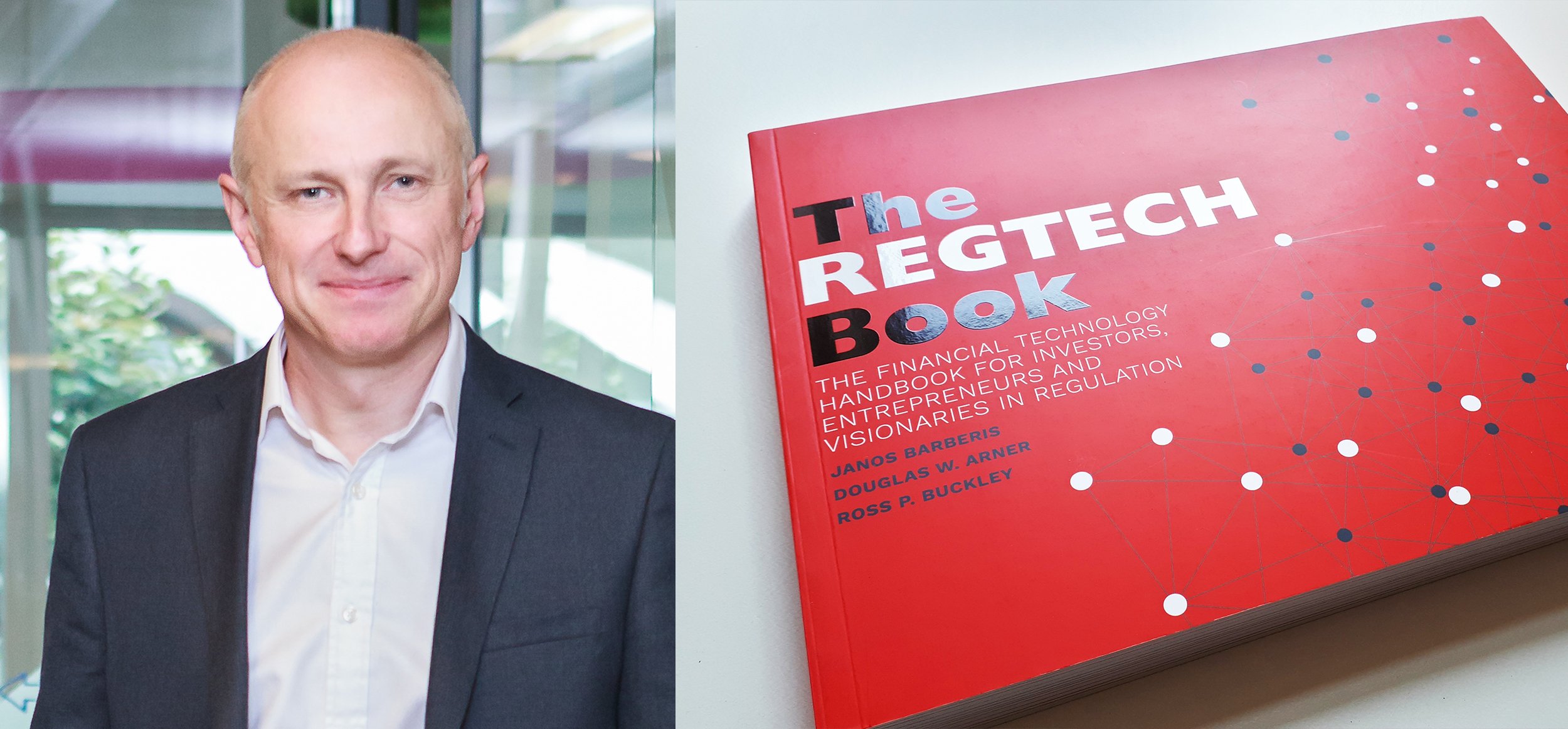

We’ve been waiting for this event for a while and finally, ipushpull CTO David Jones is a published author! He’s contributed a chapter to the newly published The RegTech Book, a comprehensive review of the fast-growing RegTech ecosystem and its potential to transform the financial services industry.

The RegTech Book covers a broad range of topics. It investigates how new technologies, including AI and blockchain, can be applied to compliance. It looks at the economic impact of digitization and datafication of regulation. And it studies how regulators themselves can help drive the process through collaborations with RegTech pioneers and innovations such as regulatory sandboxes. Other contributors bringing their industry expertise to the book alongside David include compliance professionals, regulators, business leaders and entrepreneurs.

It’s 2019 and people are still using spreadsheets

David’s chapter, Old Tech + New Tech = RegTech: Excel Spreadsheets and End User Computing in a Regulated World, describes how legacy IT and ingrained working cultures in organisations lead to business and regulatory risks. It focuses specifically on the problems of managing and de-risking the vast numbers of End User Computing (EUC) solutions, usually spreadsheets, that institutions still rely on today to keep their businesses running.

A number of widely-reported failures exacerbated by EUCs, including the ‘London Whale’ trading debacle that cost JP Morgan $6bn in 2012, prompted regulators to oblige banks to monitor and control their use. The Dodd-Frank, Basel II and Sarbanes-Oxley Acts insist that banks keep a comprehensive inventory of pricing and risk models, including EUCs, and implement internal control structures around their use.

David’s chapter discusses the actions banks must take to comply with these regulations and the RegTech tools they can use to discover the extent of their EUC dependency, maintain their EUC inventories and, ultimately, reduce the number of manual spreadsheet-driven workflows.

Breaking away

At ipushpull, we help our customers to solve the last stage of this challenge. Our platform enables them to automate manual workflows from front to back office, internally and between counterparties. This reduces spreadsheet dependency and improves efficiency and layers control, audit and monitoring over previously unmanaged processes.

Our partners at Hub85 solve the first two stages. Their innovative spreadsheet governance solution automates the discovery and management of a company’s EUC dependency, uncovers risks within sheets and maps data lineage between them. Their Business Intelligence module is particularly powerful, providing graphical insights into EUC usage from the overall organisation level down to the individual spreadsheet.

By providing insight into the real-world challenges facing financial institutions and the regulators’ response to them, plus suggesting an actionable roadmap to ultimately solving these problems, David’s chapter is representative of the wide range of articles published in The Regtech Book. It’s essential reading for compliance professionals, regulators and policymakers, and it’s available now in-store and on Amazon.

To find out more about how ipushpull can reduce your reliance on spreadsheets for business-critical processes, please get in touch with sales@ipushpull.com.

-1.png?width=2000&name=Untitled%20(45)-1.png)

.png?width=1200&height=628&name=Blog%20header-1%20(27).png)

.png)

.png)